cares act illinois student loans

CARES Act Emergency Relief. Student Loan Debt.

Current Student Loans News For The Week Of Jan 17 2022 Bankrate

Travis Hornsby CFA is Founder and CEO of Student Loan Planner.

. Students with federal student loans. The CARES Act provided relief for small businesses and laid off workers. But thats beside the point.

Pritzker said Tuesday that relief is coming for. Allows employers to contribute up to 5250 through the end of the year to each workers student loan debt tax free. The CARES Act Covers These Student Loans.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Of that money approximately 14 billion was given to the Office of Postsecondary. Below is a brief outline of the CARES Act.

It provides meaningful albeit temporary help for those who qualify by having the right kind of student loan. One component of this relates to when students have to repay their debt. Stafford loans and Pell grants received for an incomplete semester do not count towards the total number of loans or grants the student.

HFS will make final funding and policy decisions based on federal and state laws regulations and guidance. Suspended payments under the CARES Act may not be reported as a missed payment. Louis MO where he loves thinking up new student loan repayment strategies and frequenting the best free zoo in America.

So over the next six months your federally held student loans will. Under this new initiative Illinoisans with commercially-owned Federal Family Education Program Loans or privately held student loans who are struggling to make their payments due to the COVID-19. The CARES Act has two big impacts on federally held student loans.

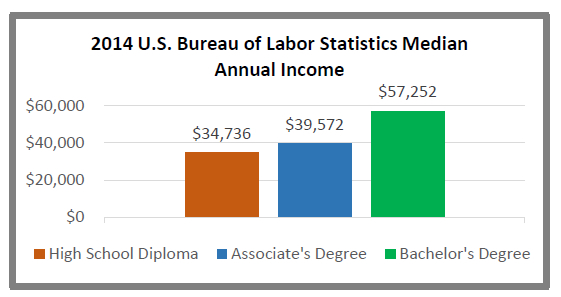

The Coronavirus Aid Relief and Economic Security CARES Act provides additional flexibility for student loan borrowers during the Coronavirus Outbreak including automatically suspending. The portal is open from September 29 2020 through noon on Saturday October 31 2020. Those students who were smarter about when they were born and attended school last year got locked in at 275.

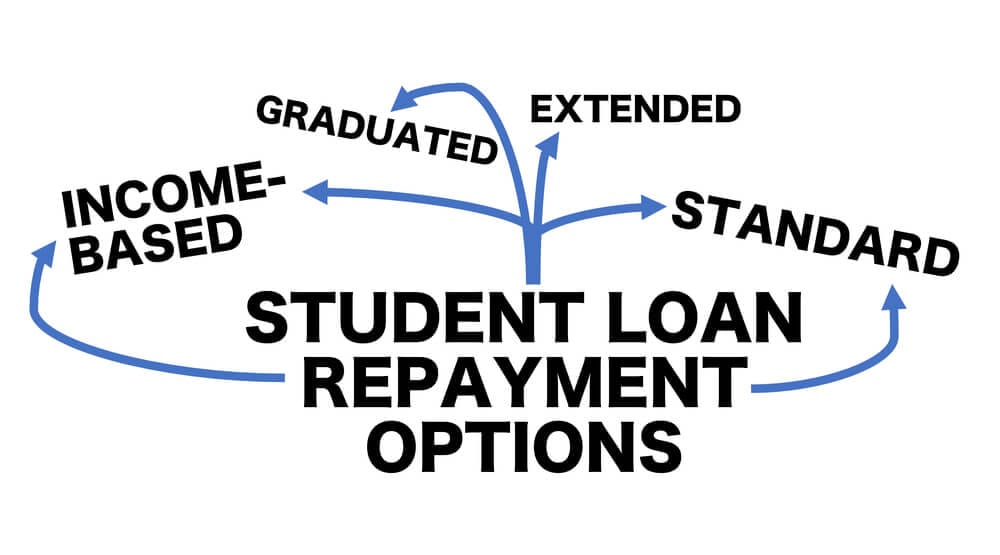

Department of Education eligible student loans for. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees student loans has been extended from the previous deadline of December 31 2020 to December 31 2025. The CARES Act wants to make those payments more manageable in times like now.

Pritzker announces relief to student load borrowers in Illinois. As one of the nations leading student loan experts he has consulted on 500 million of student debt personally. Department of Education between March 13 2020 and August 31 2022.

Under the new law no payments are required on federal student loans owned by the US. There are many benefits to student borrowers due to the CARES Act. One of its most well-known provisions concerns the repayment of federal student loans.

So if you were foolishly enrolled in school between 2006-2012 you locked in at 68. Court of Federal Claims rejected a taxpayers argument that the IRS improperly allowed the offset of a tax refund on his 2019 return filed in January 2020 against his outstanding student loan debt in violation of the CARES Act. Suspends student loan monthly payments for 6 months.

Illinois transit agencies will receive an estimated 16 billion in federal. The CARES portal can be found at httpscaresapphfsillinoisgov. Find a Dedicated Financial Advisor Now.

This order suspended all payments on Direct Loans through December 31 2020. He lives with his wife in St. Section 3513 of CARES.

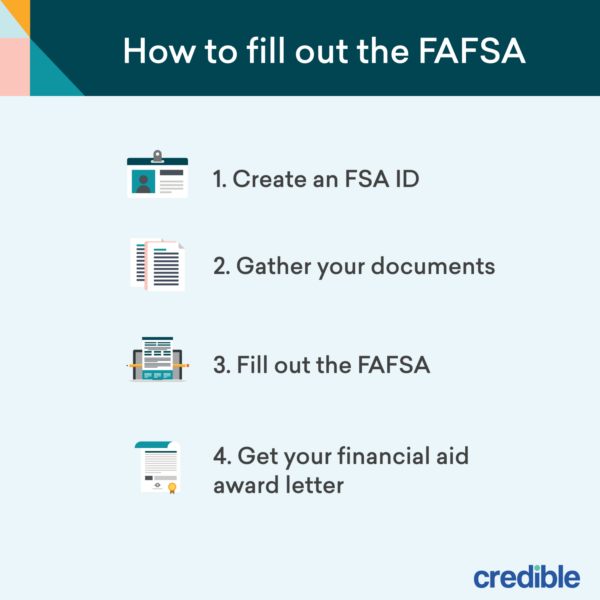

What the CARES Act means to Illinoisans March 27 2020 Congress approved and the President has signed the Coronavirus Aid Relief and Economic Security Act CARES today. The first thing that the CARES Act does is set interest on student loans to 0 through September 30 2020. This means if you filled out the FAFSA and borrowed loans as a result your loans might be affected.

However the CARES Act left out millions of student loan borrowers with federal loans that are not owned by the US Government as well as loans made by private lenders. For most borrowers all federal student loan payments and accrual of interest has been waived until September 30 2020. In addition the interest on these federal student loans will automatically drop to zero percent.

This bill allotted 22 trillion to provide fast and direct economic aid to the American people negatively impacted by the COVID-19 pandemic. The 22 trillion economic rescue package provides help for families small business hospitals local governments and others. Ad Start Your Application for Income-Based Federal Benefits for Federal Student Loans.

April 21 briefing. Allocates 25 billion in federal transit formula funding to keep public transit operating throughout Illinois in order to ensure continued access to jobs medical treatment food and other essential services. So assume two people both took on 32k in debt.

The Student Investment Account Act 110 ILCS 991 permits the Office of the Illinois State Treasurer Treasurer to establish the Student Investment Account which will invest up to five percent 5 of the State Investment portfolio on a continuing and recurring basis approximately 800 million as of January 2021 in affordable and responsible education loan products. A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. CARES Act Relief for Borrowers of Eligible Federal Student Loans Tuesday April 7 2020 Relief for borrowers of student loans owned by the US.

The 880-page Coronavirus Aid Relief and Economic Security Act CARES has 4 pages of help for certain student loan borrowers. On Tuesday Gov. Education Stabilization Fund Transparency Portal March 17 2021 Covid-Relief-Dataedgov is dedicated to collecting and disseminating data and information about the three primary ESF programs that the Coronavirus Aid Relief and Economic Security CARES Act authorized and the Department manages.

The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020. Do Your Investments Align with Your Goals. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers.

As the opinion pointed out in the case of Seto v. Student loan interest gets locked for life at the time you take it. How the CARES Act Changes Health Retirement and Student Loan Benefits The Coronavirus Aid Relief and Economic Security CARES Act alters employee benefit rules particularly for health coverage.

Pritzker said the state has secured relief options for student loan borrowers who werent previously covered by the federal CARES Act which provides relief to those with federal loans but not to those with private loans or federal loans not owned by the federal government.

Student Loan Forgiveness Programs The Complete List 2022 Update

Many Student Loan Borrowers Missed A Chance To Exit Default Money

More Companies Are Wooing Workers By Paying Off Student Debt Money

How To Get A Student Loan Money

Who Owes The Most In Student Loans New Data From The Fed

Solutions For Student Debt A Call To Action News

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Income Based Repayment Of Student Loans Plan Eligibility

What To Know About The Debate Over Student Loan Forgiveness Npr

Student Loan Scams 3 Warning Signs To Watch For Money

The Full List Of Student Loan Forgiveness Programs By State

The Cares Act And Student Loans A Guide I Morgan Stanley At Work

Make Student Loan Debt Dischargeable In Bankruptcy Again

Statute Of Limitations On Private Student Loans State Guide Credible

Student Loan Forgiveness Programs Credible

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Requirements How To Qualify For A Student Loan